As the Shanghai Composite Index recently reclaimed the 3,600-point mark amid a bullish market rally, Guangdong's club of 100-billion-yuan market cap enterprises has expanded rapidly.

A review by our reporter of A-share listed companies reveals that, as of August 1, 2025, Guangdong had 26 enterprises with a market capitalization exceeding 100 billion yuan. Over the past year, nine new companies have joined this elite group. Driven by the AI revolution, industrial powerhouses like Shenzhen, Huizhou, and Dongguan are now emerging as hubs for 100-billion-yuan market leaders. Notably, the PCB (printed circuit board) sector has stood out, with top players such as Victory Giant Technology, Avary Holding, and SYTECH repeatedly hitting record-high valuations. In the past year, this sector has seen the emergence of four enterprises reaching market values exceeding 100 billion yuan. Additionally, Eastroc Beverage and Kuang-Chi Technologies have also successfully entered the 100-billion-yuan market cap club during the same period.

As this capital frenzy continues, which contenders will step up to chase the next 100-billion-yuan milestone? Given the recent shifts in the 100-billion-yuan club, niche sectors underpinned by AI infrastructure hold the strongest promise. Shengyi Electronics, a major player in PCB, and Envicool, a pioneer in liquid cooling technology, are emerging as top candidates to become the next 100-billion-yuan market cap stock.

Guangdong's 100-billion-yuan Club Adds 9 New Members

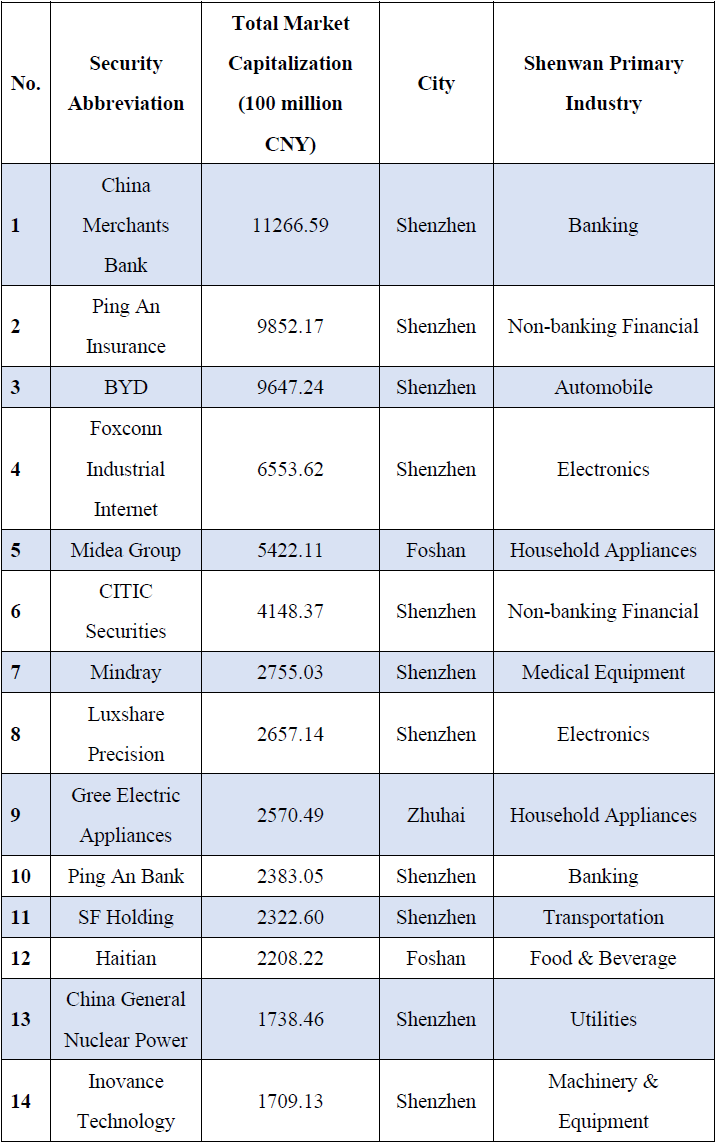

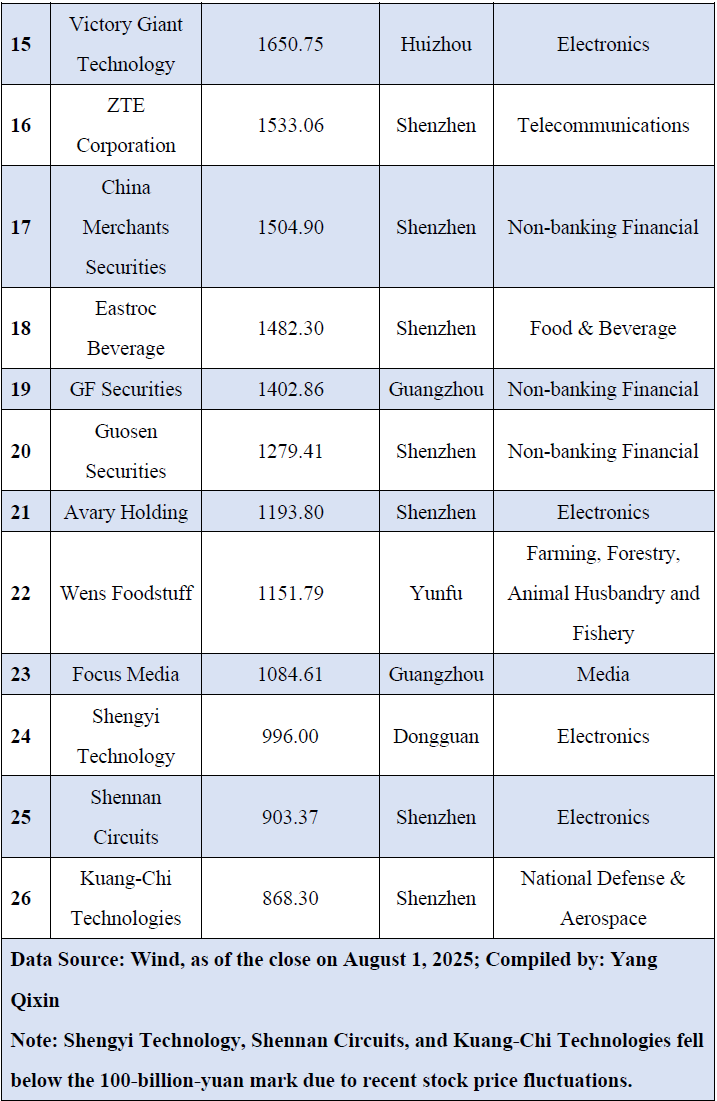

Wind data shows that as of the close on August 1, 2025, there were 26 companies with a total market capitalization exceeding 100 billion yuan. Among them, China Merchants Bank, Ping An Insurance, and BYD ranked the top three in market value, standing at 1.126659 trillion yuan, 985.217 billion yuan, and 964.724 billion yuan, respectively.

By region, these enterprises with high market capitalizations are highly concentrated in Shenzhen, with as many as 18 based there. Guangzhou and Foshan collectively host two, while Dongguan, Huizhou, Yunfu, and Zhuhai each have one.

In terms of industry, the electronics sector leads with six companies reaching the 100-billion-yuan threshold, followed by five in the non-bank financial sector. The banking, home appliances, and food and beverage sectors each have two. Meanwhile, automotive, biomedicine, utilities, machinery, transportation, telecommunications, farming/forestry/animal husbandry/fishery, media, and defense industries each have one company in the elite club.

Over the past year, Guangdong's 100-billion-yuan market cap club has continued expanding with nine new entrants.

Among them, Victory Giant Technology, Eastroc Beverage, Shengyi Technology, Shennan Circuits, and Kuang-Chi Technologies surpassed the 100-billion-yuan threshold for the first time since their listings. However, the stock prices of Shengyi Technology, Shennan Circuits, and Kuang-Chi Technologies have recently pulled back, with their market values falling below the benchmark. As of August 1, their respective valuations stood at 99.6 billion yuan, 90.337 billion yuan, and 86.83 billion yuan, respectively. Meanwhile, GF Securities, Guosen Securities, Focus Media, and Avary Holding have seen their market caps rebound to the 100-billion-yuan mark over the past year.

In terms of stock performance, Victory Giant Technology, Kuang-Chi Technology, and Shengyi Technology saw the top three gains, each exceeding 100% growth. Data shows that Victory Giant Technology's market cap surged from 33.058 billion yuan to 165.075 billion yuan over the past year, driving its stock price up by a staggering 398.38%. Next, Shengyi Technology's market cap rose from 47.546 billion yuan to 99.6 billion yuan, marking a 114.4% upswing. Meanwhile, Kuang-Chi Technologies' market cap climbed from 38.632 billion yuan to 86.83 billion yuan, achieving 125.70% growth. Eastroc Beverage's market cap grew from 93.478 billion yuan to 148.23 billion yuan, representing an increase of 61.54%.

Overall, companies such as Victory Giant Technology, Avary Holding, Shengyi Technology, Shennan Circuits, Eastroc Beverage, and Kuang-Chi Technologies were propelled by sector-specific growth drivers. GF Securities, Guosen Securities, and Focus Media were influenced primarily by sectoral cyclical fluctuations.

Specifically, Victory Giant Technology, Shengyi Technology, Avary Holding, and Shennan Circuits all operate within the PCB sector, a niche segment within the electronics industry. A core dynamic fuels their growth. Since 2024, the AI-driven technological revolution has accelerated development in downstream sectors, including computing power, high-speed network communication, new-energy vehicles, and autonomous driving. This has triggered a surge in structural demand for high-end PCBs. However, supply-side capacity constraints persist, propelling the PCB sector into a new cycle of rapid growth.

Kuang-Chi Technologies' growth is underpinned by two key pillars: first, the vigorous development of cutting-edge aerospace equipment manufacturing; second, its unique solutions leveraging integrated structural-functional metamaterial technology, which creates significant competitive barriers in this field, and successfully extends to emerging markets such as the low-altitude economy, smart vehicles and humanoid robots.

As for Eastroc Beverage, the primary driver behind its substantial market cap increase stems from a dual catalyst. The accelerated modern lifestyle rhythms expand energy consumption scenarios from fitness and sports to high-frequency daily contexts such as work, study, and outdoor activities. Coupled with its affordable pricing strategy, which aligns precisely with the current trend of consumption downgrading, this synergy has effectively boosted market share growth and sustained improved corporate performance.

Who Will Be the Next 100-billion-yuan Market Cap Enterprise?

Recent shifts in the 100-billion-yuan market cap club reveal the PCB sector's meteoric rise driven by AI development, with four new entrants reaching this milestone. This underscores the immense potential of AI-related industries. It is foreseeable that Guangdong's next 100-billion-yuan market cap enterprise will most likely arise from AI-related sectors.

Taking all factors into account, among Guangdong's listed enterprises, Shengyi Electronics from the PCB sector, and Envicool, a leading provider of liquid cooling technology, stand out as strong contenders for this achievement.

Currently, AI infrastructure remains in its early stage, with global tech giants continuously ramping up capital expenditure. As a core infrastructure supplier, the PCB industry is poised to enter a sustained period of robust growth across the entire industrial chain. According to the third-party research firm Prismark, the global PCB output value is projected to reach 78.6 billion USD in 2025, with output and shipment growth rates of 6.8% and 7.0% respectively.

The sector's high-growth prospects indicate fertile ground for nurturing 100-billion-yuan enterprises, with Shengyi Electronics demonstrating significant potential to reach this milestone. Founded in 1985, Shengyi Electronics has long been dedicated to the PCB industry and ranks among China's leading PCB manufacturers. Backed by Shengyi Technology, a leading copper-clad laminate producer, the company enjoys strong synergies in upstream core raw materials.

As of August 1, 2025, Shengyi Electronics reported a total market capitalization of 43.739 billion yuan. According to its 2025 semi-annual performance forecast, the company is expected to achieve operating revenue between 3.65 billion yuan and 3.882 billion yuan in the first half of the year, representing a year-on-year increase of 84.98% to 96.73%. Its net income attributable to parent company shareholders is projected to range from 509 million yuan to 546 million yuan, surging 461.80% to 503.43% year-on-year. Currently, Shengyi Electronics is continuously optimizing its product mix, steadily adjusting its production capacity layout, and increasing the proportion of high-value-added products to further consolidate its competitive edge in the mid-to-high-end market.

Furthermore, the evolving application scenarios of AI have raised higher requirements for computing power equipment and data centers that support it. As computing power density escalates, traditional air cooling systems are struggling to meet heat dissipation needs, making efficient liquid cooling an essential component of the computing industry. Data shows that liquid cooling systems can save 30-50% electricity compared to traditional air cooling systems.

Driven by annual 100-billion-yuan new market opportunities and trillion-yuan-scale data center energy-saving retrofits, China's liquid cooling industry has maintained rapid growth in recent years. According to IDC (International Data Corporation), China's liquid cooling server market will reach 3.39 billion USD in 2025, a 42.6% year-on-year increase. From 2025 to 2029, the market is expected to grow at approximately 48% CAGR, reaching around 16.2 billion USD by 2028.

In this field, Envicool stands out as a leading provider of precision temperature control and energy-saving solutions. Its liquid cooling technology is widely applied in data centers and computing equipment, making it one of the few companies in the liquid cooling field with full-chain products. Having secured partnerships with industry giants such as NVIDIA, Intel, and Huawei, Envicool has captured 30% of global liquid cooling orders and set a record of zero leakage for a 1.2GW project, solidifying its position as a leader in the data center temperature control industry. Currently, Envicool supplies a large number of efficient and energy-saving refrigeration systems and products to major data centers of clients, including ByteDance, Tencent, Alibaba, Chindata Group, GDS, AtHub, China Mobile, China Telecom, and China Unicom.

The competitive edge of Envicool lies in its full-chain independent R&D and manufacturing capabilities covering cold plates, pipelines, quick connectors, CDUs (cooling distribution units), and coolants. As of August 1, 2025, its total market capitalization stands at 39.745 billion yuan, with its stock price rising 35.84% year-to-date. In 2024, Envicool reported an operating revenue of 4.589 billion yuan, a 30.04% year-on-year increase, and a net income attributable to parent company shareholders of 453 million yuan, up 31.59% year-on-year. Notably, based on disclosed audit results, the company has achieved double-digit growth in both revenue and profits for 14 consecutive years.

However, it should be noted that stock fluctuations are subject to macroeconomic conditions, capital flows, and market sentiment. Therefore, there remains some uncertainty as to which Guangdong listed company will be the first to break through the 100-billion-yuan market cap threshold in the future.

Wu Jialin, a reporter from Southern Finance Omnimedia Corp., also contributed to this article.