By Shi Shi, Li Yinong, SFC, 21st Century Business Herald

Editor’s Note:

As the world moves toward 2026, multiple economic cycles and structural shifts are converging. Global growth remains uneven, inflation and monetary policy paths are uncertain, and geopolitical tensions and industrial realignments continue to reshape the international order. At the same time, China enters the starting phase of 15th Five-Year Plan, with implications that extend well beyond its borders.

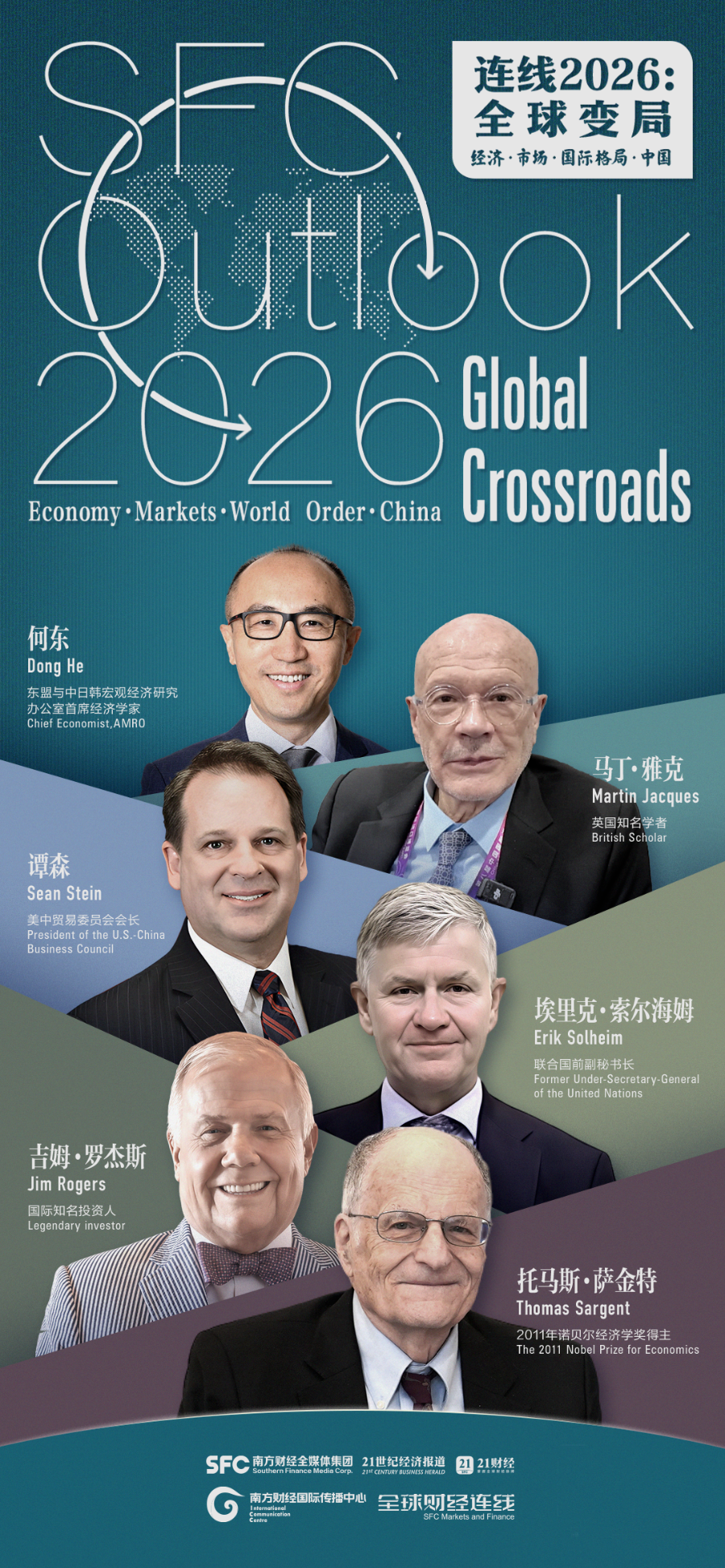

SFC Outlook 2026: Global Crossroads brings together distinguished economists, scholars, investors and political figures to assess the global economy, financial markets, the evolving world order, and China’s development at this critical juncture. Through in-depth conversations and forward-looking perspectives, the series offers a comprehensive outlook on the forces shaping the years ahead.

China is advancing high-quality development with steady and far-reaching momentum.

In 2025, the global economy faces growing complexity amid geopolitical tensions, persistent trade frictions, and the rapid rise of artificial intelligence. Uncertainty surrounding U.S. tariff policies remains high, while China continues to send stabilizing signals to the world economy through technological innovation, industrial upgrading, and institutional resilience.

Thomas J. Sargent, Nobel laureate in Economic Sciences (2011) and Professor of Economics at New York University, shared his views in an exclusive interview with SFC reporter. He noted that China’s development is remarkable not only for its speed, but also for the resilience embedded in its institutional design, long-term planning, and innovation capacity. From his early visits to Hong Kong and Shenzhen in the early 1980s, to Beijing in 2012, and more recent trips to Shanghai, Guangzhou, and other cities, Sargent has personally witnessed China’s transformation over more than four decades.

Sargent emphasized that China’s high-quality development goes beyond economic growth, reflecting systematic innovation and the building of strong industrial ecosystems. In the automotive sector, for example, China has moved from producing low-end vehicles for developing markets to becoming a global leader in innovation—a transformation mirrored in areas such as artificial intelligence, research, and education.

Against rising uncertainty in the global trading system, Sargent observed that frequent U.S. policy shifts, tariffs, and trade wars have raised global costs and disrupted supply chains, undermining innovation efficiency. By contrast, China’s open and inclusive policies have helped bolster confidence and created new opportunities for international cooperation.

Looking ahead to the 15th Five-Year Plan period, Sargent underscored the importance of planning in China’s economic governance. China’s Five-Year Plans, he said, provide a clear and continuous framework for action, reflecting patience and long-term vision—qualities that underpin China’s economic resilience amid global uncertainty.

Witnessing China’s Miraculous Development Across Multiple Sectors

SFC Markets and Finance: You visited many Chinese cities in the past few years, I think you are a witness to China's high quality development. How do you think about China's development?

Thomas Sargent: I went to Hong Kong 42 years ago. At that time, Shenzhen was just beginning. I did not visit China for a long time afterward. I returned to Beijing in 2012, and the changes were amazing. After that, I started visiting other cities.

I went to Shenzhen around 2014 or 2015, and also to Shanghai. The experience was striking, because these cities are clearly world-class.

Around 2013 and 2014, I attended some conferences, including one focused on the automobile industry. At that time, China was trying to get into auto industry. They were producing very low-end cars, intended for sale in poorer countries at very low prices, far from the vehicles we see today. They were considering the entire ecosystem. Watching this beginning, I thought they were far behind—but also very ambitious.

I never imagined that just a few years later, I would witness such rapid progress. Some of my friends bought a Huawei car for under $50,000, equipped with AI. It was the best car I have ever been in. There are now many excellent cars with automatic driving, beautiful designs, crafted with architectural precision. From my perspective, I have witnessed a near-miraculous transformation in the auto industry—and similarly in other sectors.

As a teacher, I try to learn economics, mathematics, and statistics. I have had the privilege of working with some Chinese students who became my friends and have taught me a great deal. I have observed their progress and seen them at the cutting edge fields like statistics and mathematics, it is truly an extraordinary human adventure to witness.

I think of this as entrepreneurship. There is a lot of science involved, but research itself is a form of entrepreneurship—you are trying new ideas without knowing what will succeed. It is both art and creativity. I have seen remarkable creativity among young Chinese students and scholars, and I have benefited from it as an academic collaborator.

In recent years, most of my serious papers have been co-authored with Chinese colleagues, who contributed substantially to the work. I will just say that I am lucky to work with them.

There is no reason not to be enthusiastic and full of confidence in China’s development.

The Five-Year Plans Play a Key Role in China’s Development

SFC Markets and Finance: 2026 is the beginning of the 15th Five Year Plan. How do you feel about that?

Thomas Sargent: I am fascinated. Let me tell you—this is personal, not about any country; it’s about me. I have always had a five-year plan for myself. What am I going to do? It’s interesting. I somewhat model it after, you could say, the Chinese government. It’s not a detailed list of everything I plan to do, but a general framework of action.

Each plan is connected to the previous one. I reflect on what I have accomplished—did I exceed my goals or fall short? Do I want to adjust any of them? It’s more like a framework than a strict schedule. Reading the plans together is interesting, because you can see coherence across them.

I have witnessed something remarkable in China. In the second half of my life, China has achieved things that were not here when I was 40. Back then, China was not standing for openness, and many of the developments I see today did not exist. These achievements are connected to China’s five-year plans, which have helped create the transformations I have observed.

High‑Level Technological Self‑Strengthening Highlight Economic Resilience

SFC Markets and Finance: Actually, one key point is technological self-reliance. How do you think about that, and how does that stimulate Chinese economy?

Thomas Sargent: Resilience is a subject near to my heart, because I am essentially a nerdy, technical macroeconomist. One area I work on with my friend Lars Hansen is what we call robustness. It is about how to design decisions when you are uncertain about the environment and want to build in flexibility. We call it robustness—designing something that will work across a variety of environments. It is extremely important. This is what good engineers or designers focus on.

Now is a particularly special time to consider it, because of the disorder being created—unfortunately, I have to say, by some actions of my own country—in the global trading system. In such circumstances, building resilience is exactly what a good economist or engineer would think about.

SFC Markets and Finance: I know you are a great supporter for open source. Now we are in the era of AI, besides competition, what can we do to promote AI and enhance cooperation?

Thomas Sargent: I am a consumer and a beneficiary of DeepSeek, and I really appreciate their philosophy. I work on QuantEcon, which is a much smaller endeavor. Unlike DeepSeek, we focus on open-source teaching of economics and statistics. We code in Python and freely share our code. Often, people in China take our code and say, “We could make this better,” which we love.

It is open source, it is cooperative.

DeepSeek represents the gold standard of open source. I am just a small contributor, but what they are doing is truly magnificent. They have gained attention because they write sophisticated scientific papers, publish them, and share their code. I really appreciate that model.

Countries That Embrace Trade Will Prosper More

SFC Markets and Finance: Many countries talk about economic security and supply chain resilience. Do you think that makes free trade harder?

Thomas Sargent: The disorder, tariffs, and uncertainty—originating from my own government—the U.S., have increased costs around the world and disrupted businesses. I am a loyal citizen, but these developments have had real economic consequences.

Businesses will naturally respond and adapt by adjusting their supply chains. However, this process raises costs for everyone. Goods become more expensive when production is no longer sourced from the lowest-cost locations. Business leaders, smart managers, and accountants are now trying to determine how to reorganize supply chains. They will be creative in working around these constraints, but the resulting arrangements are often less efficient.

These adjustments come at a cost. The time, effort, and resources devoted to navigating this disorder could instead have been used to create something genuinely productive—another DeepSeek, for example. That is why this is costly for everyone, and why I do not like it. Many economists share this view.

SFC Markets and Finance: What do you think about future of free trade?

Thomas Sargent: One thing I learned from the woman from Rwanda made me more optimistic.

I was sad because I see my own country, the United States, threatening and imposing tariffs on its neighbors—on everyone, including our closest neighbors, Mexico and Canada, and countries within our own hemisphere.

What made me optimistic was her description of China’s zero-tariff policy with large parts of Africa. She explained how this policy benefited her country, and how, in response, her government is trying to build stable relationships and make the most of those opportunities.

That gives me hope. I believe there will be free trade in some parts of the world, and countries that take advantage of it will prosper more than those that do not. That is Economics 101.

SFC Markets and Finance: I know you attended the CIIE many times, how do you think about the CIIE, and what kind of role does it play in global trade?

Thomas Sargent: For someone like me, who wants to learn and observe, and to talk with and listen to people engaged in international trade—business leaders, government officials interested in promoting trade and in regulating it—this is simply wonderful. It feels like going to school for free.

In general, conferences like this are truly for the participants. It is a real privilege and something quite special. Especially in 2025, and partly because of what my federal government is doing in igniting trade wars, this experience feels even more meaningful. As an economist, I can say that most economists do not like trade wars. They do not like tariffs; they favor free trade, openness, and the exchange of ideas. I am no different from other economists in that respect.

I do not like trade wars. I believe no one wins a trade war—that is what economics teaches us. Economics is grounded in enduring principles, and those principles have not changed.

SFC Markets and Finance: China often talks about openness and shared growth through the CIIE. What kind of contribution do you think it brings to the global economy?

Thomas Sargent: I think whenever large groups of serious, thoughtful people come together and express support for trade, it sends a message—a truly refreshing message.

Long-Term Development Is at the Core of China’s Planning

SFC Markets and Finance: What's the future of the global economy?

Thomas Sargent: The actions of the federal government in the United States raise fundamental questions: are we going to have high tariffs or low tariffs? Are tariffs intended to raise revenue, or are they designed not to raise revenue at all but instead to shut down trade entirely? These are very different objectives.

The signals coming from my government change daily and are often contradictory. On the one hand, there is talk of raising revenue; on the other, of rebuilding manufacturing. You cannot realistically do both at the same time.

A great deal of risk has been introduced by government actions, and in parts of the world this has created disorder and unpredictability for others. As a result, forecasting has become much more difficult. That said, I have learned something about how other parts of the world are responding—by shifting and creating new areas of free trade. That is something I will continue to watch closely.

SFC Markets and Finance: How about China's economy?

Thomas Sargent: If you are my age, you observe Chinese leadership—by which I mean both business leaders and government officials—and you see a strong sense of patience and a commitment to the long term. If you read Chinese history, this long view and emphasis on patience are deeply embedded. That is why I am optimistic.

Chief Producer: Zhao Haijian

Supervising Producer: Shi Shi

Editor: Li Yinong

Reporter: Shi Shi, Li Yinong

Video Editor: Cai Yutian

Poster Design:Lin Junming

New Media Coordination: Ding Qingyun, Zeng Tingfang, Lai Xi, Huang Daxun

Overseas Operations Supervising Producer: Huang Yanshu

Overseas Content Coordinator: Huang Zihao

Overseas Operations Editors: Zhuang Huan, Wu Wanjie, Long Lihua, Zheng Quanyi

Produced by: Southern Finance Media Gorp.